If I get a 1099C, does that mean my debt is paid? A form 1099C, Cancellation of Debt, is issued by a creditor when a debt is discharged for less than the full amount you owe following an identifiable event and that amount is $600 or more (you A 1099A is used when you a lender forecloses on your house or you abandon your house A 1099C is used when you have debt canceled or forgiven When will I get a Form 1099C?

Doing Business In The United States Federal Tax Issues Pwc

What is 1099 c form

What is 1099 c form-According to the IRS, in certain circumstances applicable creditors must file a 1099C form for " each debtor for whom they canceled $600 or more of a debt owed " Sometimes this form will be sent to you as a result of a debt which you settled for less than originally owed The analysis of the various codes used on Form 1099C is beyond the scope of this post but, in general, code "G" means there was a "decision or policy to discontinue collection" See Department of Treasury, IRS, Form 1099C (15) Because of this, the court said that there was some question as to whether the debt was discharged or not

Debt Forgiveness The Pros And Cons Lexington Law

A Form 1099C is an informational form sent by the creditor to the IRS, with a copy sent to you It means that your debt meets certain qualifications; You'll receive a Form 1099C, "Cancellation of Debt," from the lender that forgave the debt For more information, please see When to Use Tax Form 1099C for Cancellation of Debt But even if you receive a Form 1099C from a lender, you still may be able to avoid taxation on the forgiveness of a debtThe simple act of receiving a 1099C does not mean your debt is paid in full "In some cases the settlement may only be for a portion of the total balance, meaning that there is still

What is Form 1099C, Cancellation of Debt?If your lender agreed to accept less than you owe for a debt, you might get aIf a debt is canceled, your lender is supposed to send you and the IRS a Form 1099C This form will provide information regarding your debt, including the total amount lent to you, how

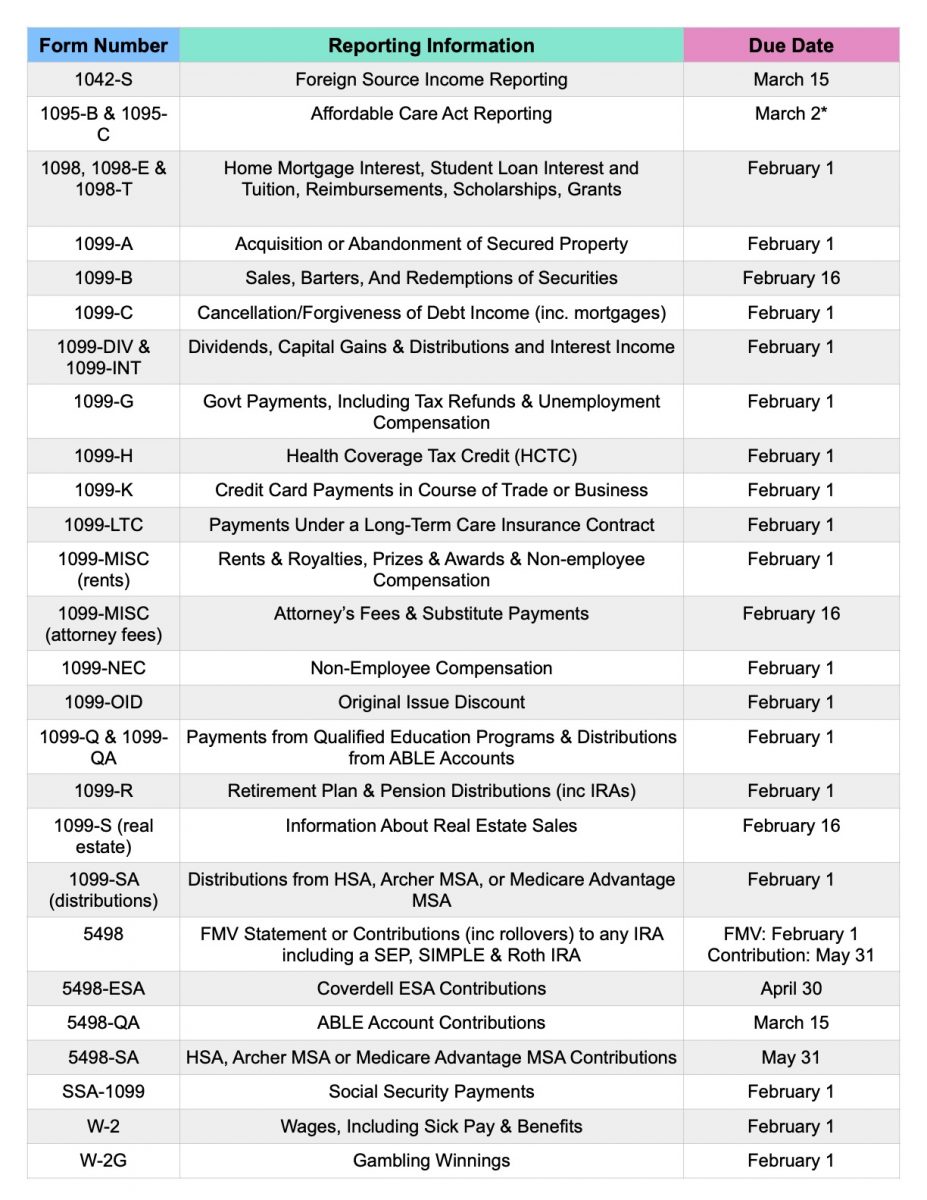

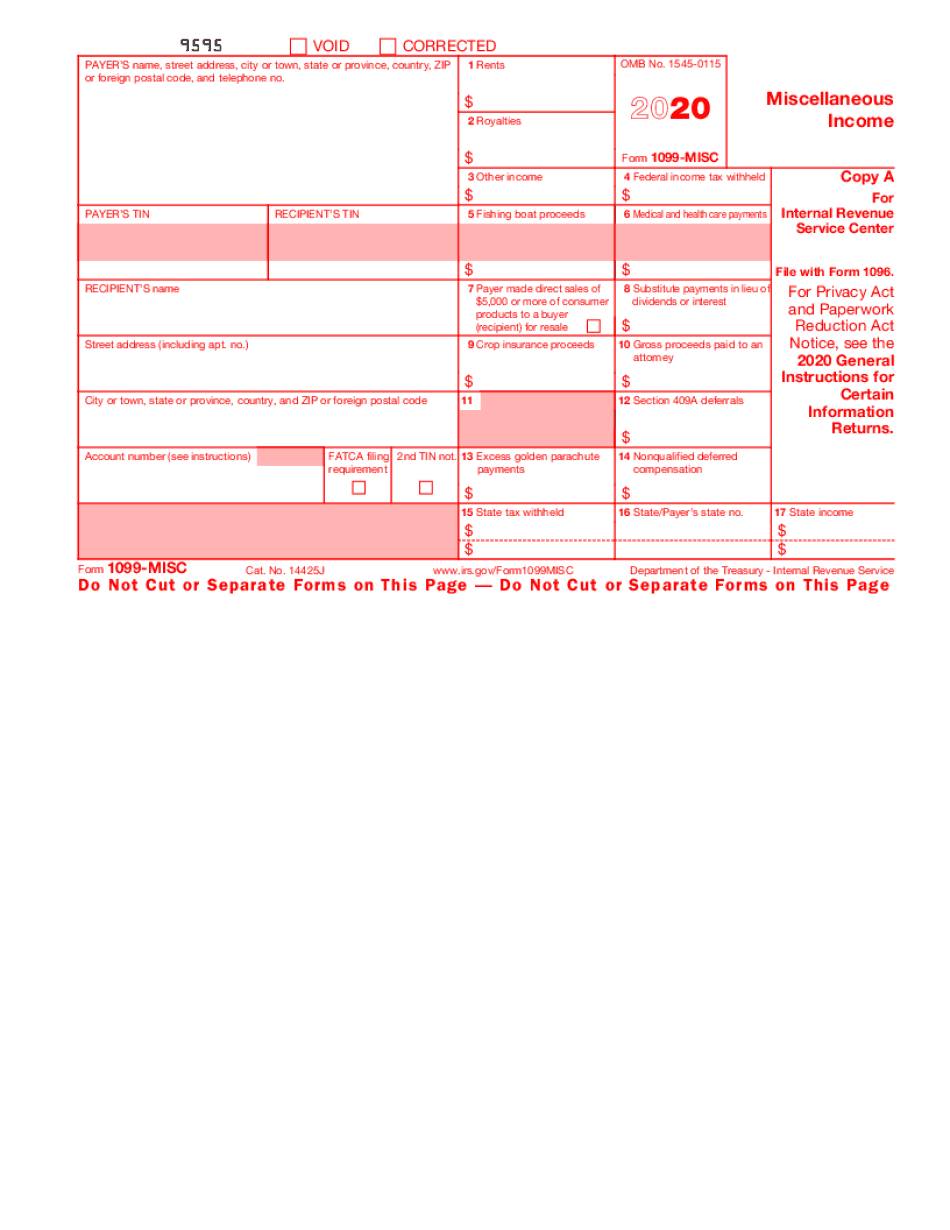

Simply so, what does Code F mean on a 1099 C? Form 1099G This lists government payments like unemployment benefits and tax refunds Form 1099R This documents payments from annuities, pensions, retirement plans and profitsharing plans Form 1099C Used whenever a taxpayer writes off debts exceeding $600 Form 1099Q Documents payments from Qualified Education ProgramsIf you have a taxable debt of $600 or more that is canceled by the lender, that lender is required to file Form 1099C with the IRS The lender is also required to send you a

A Complete Guide To Cryptocurrency Taxes Taxbit

Www Ficpa Org Sites Default Files Content Files Docs Ematerials Materials 12as F2 Heinkel Taxconsequencesofbankruptcy Pdf

Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) If you're using a 1099 employee, you will first want to create a written contract If you pay them $600 or more over the course of a year, you will need to file a 1099MISC with the IRS and send a copy to your contractor If you need help with employee classification or filing the appropriate paperwork, post your need in UpCounsel's marketplace Form 1099C is a tax form required by the IRS in certain situations where your debts have been forgiven or canceled The IRS requires a 1099C form for certain acts of debt forgiveness because it considers that forgiven debt as a form of income

Will A 1099 C Hurt My Credit Score Credit Com

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

If a lender forgives or settled a debt worth more than $600, the lender must send you and the IRS a Form 1099C at the end of the year This form is for reporting income when you file your taxes for the year your lender forgave your debt The IRS will expect you to report that amount as incomeA form 1099C is a tax document used to report a debt of more than $600 when it is canceled by the lender The lender creates and mails this form to the debtor The debtor reports the amount from the 1099C because they are liable for the taxes that may be owed on that amount Form 1099A vs Form 1099C You might receive Form 1099C instead of or in addition to Form 1099A if your lender both foreclosed on the property and canceled any remaining mortgage balance that you owed Forgiven debt reported on Schedule 1099C is unfortunately taxable income

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 18compositeform1099guide Pdf La En

For example, that it is considered uncollectible It does not qualify as a contract or settlement between you and your creditor If you browse the Internet, you'll find many people adamantly Form 1099C According to the IRS, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you You'll receive a Form 1099C, "Cancellation of Debt," from the lender that forgave the debtSince the IRS considers any 1099 payment as taxable income, you are required to report your 1099 payment on your tax return, meaning you still need to report you 1099 payment even if you did not receive a 1099 Form Don't assume you're off the hook for reporting income if you don't receive a Form 1099 by February

Tax Forms Irs Tax Forms Bankrate Com

6 Types Of 1099 Forms You Should Know About The Motley Fool

Because the IRS says you have to The Form 1099C denotes debts that have been forgiven by creditors It is also known as a "cancellation of debt" According to the IRS, lenders must file this form for each debtor for whom they canceled $600 or more of a debt owed to them A 1099C is sent when a consumer settles a debt with a creditor, or the creditor has chosen to notForm 1099C A form that a lender files with the IRS if it cancels a debt in excess of $600 Lenders are required to file 1099C whether the borrower is a natural person or legal person Farlex Financial Dictionary © 12 Farlex, Inc

Schedule C An Instruction Guide

Understanding Your Tax Forms The W 2

A 1099C form is a tax form that you may receive if you've had a debt forgiven However, sometimes a creditor or debt collection company may still try to collect on a debt on which you received the form If you believe this is happening to you, here's what you need to know Form 1099C, Cancellation of Debt, is used by lenders and creditors to report payments and transactions to the IRSCanceled debt typically counts as income for the borrowers, so this income must be reported to taxpayers so they can pay taxes on it in the applicable year IRS Form 1099C is an informational statement that reports the details about a debt that was canceled You can expect to receive the form from any lender that has forgiven a balance you owe, no longer holding you liable for repaying it

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What Is A 1099 Form And 1099 Form Tips Freelancers Need To Know

Earnings reported by brokerages on a 1099DIV or 1099INT often go on the first page of your 1040 tax form, Smith says Earnings on a 1099MISC may be reported on your Schedule C, which denotes What Is a 1099C? What is a 1099C form?

List Of The Most Common Federal Irs Tax Forms

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

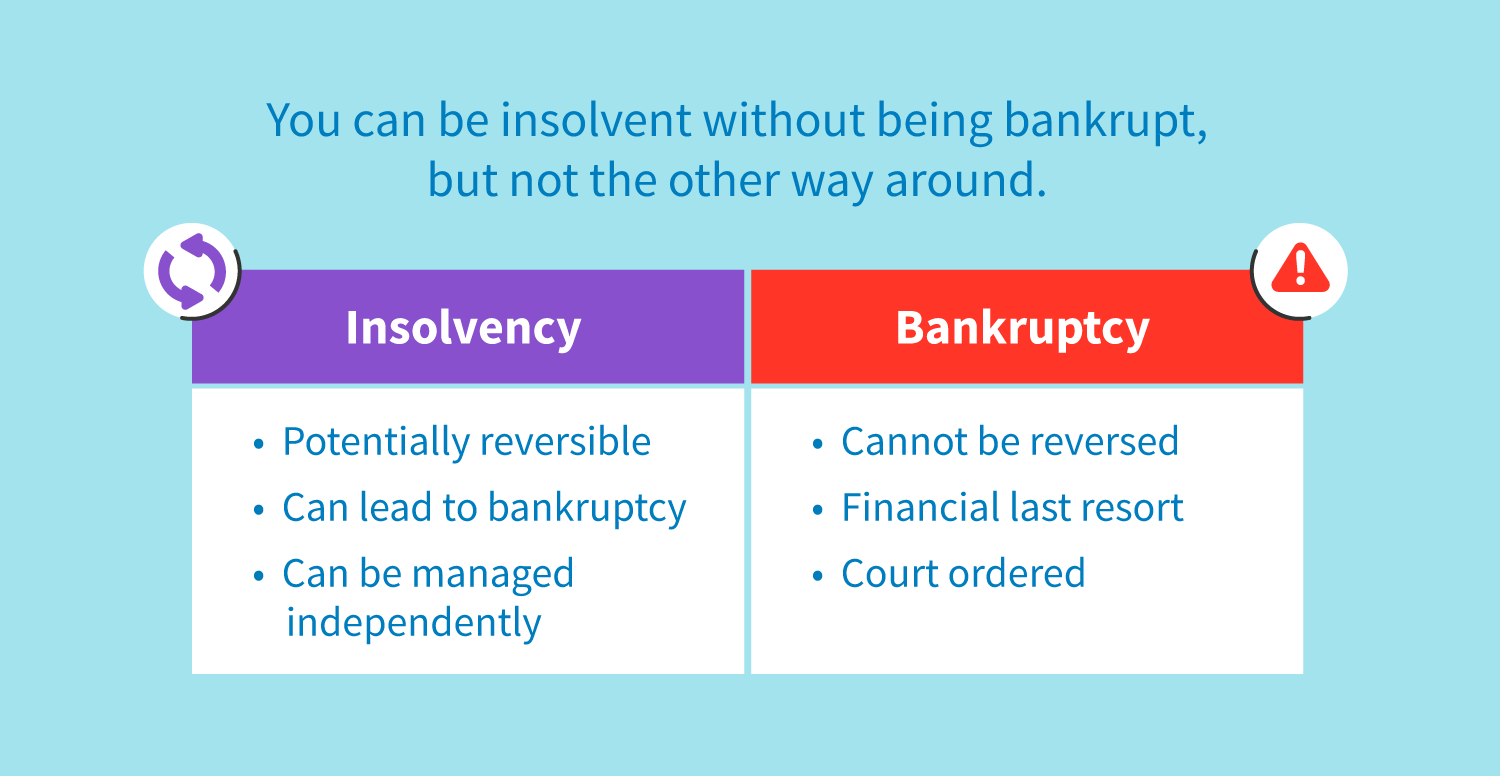

1099C reports cancellation of debt, such as when credit card debt is settled for less than the full balance, or a house is sold in a "short sale" or is foreclosed If there is over $600 of cancelled debt, then a 1099C is required to be filed by the creditor 86 viewsA 1099C reports Cancellation of Debt Income (CODI) A lender is supposed to file a 1099C form if it "cancels" $600 or moreIRS Form 1099C Cancellation of Debt and Insolvency Exclusion Overview This statement is designed to provide information and instruction for individuals who have received a Cancellation of Debt Form 1099C If you have reached a compromise or settlement with a creditor agreeing to release you from any further obligations regarding the repayment of a debt, a credit card debt

Doing Business In The United States Federal Tax Issues Pwc

What Is A 1099 Form And 1099 Form Tips Freelancers Need To Know

On the screen titled Cancellation of Debt Form 1099C Information, enter the information from Form 1099A as follows Enter Box 1 (1099A) in Box 1 (1099C) Generally, enter Box 2 (1099A) in Box 2 (1099C) However, if the amount of debt canceled is different from the amount reported in Box 2 of your 1099A, enter the amount of debt actually See " Does the 1099C form mean my debt is canceled?" below) The IRS requires banks and other creditors who forgive debts of $600 or more to file the forms Why? In the forms mode (in desktop/cd versions of TurboTax), scroll down the forms list and look for 1099C worksheets (with the name of the issuing company) 0 1

1099 C Discharge Without Debt Cancellation Not Consumer Protection Law Violation Mcglinchey Stafford Pllc

Look Out For Most Tax Forms Including Your W 2 By February 1 Taxgirl

In fact there is a code for the 1099C that appears to be tailor made for debt settlement reporting Code F — By agreement "Code F is used to identify cancellation of debt as a result of an agreement between the creditor and the debtor to cancel the debt at less than full consideration" – SourceSpecific Instructions for Form 1099C, later Property "Property" means any real property (such as a personal residence), any intangible property, and tangible personal property except the following •No reporting is required for tangible personal property (such as a car) held only for personal use However, you must file Form 1099A if the property is totally or partly The Form 1099A In More Detail The left, top, side of the form has the payer's information, and your information is on the left, lower side of Form 1099C Either your full Social Security Number (SSN), or perhaps only the last couple digits, is likely to be printed there as well

How To Apply For A Ppp Loan If You Re Self Employed Nav

The Schedule K 1 Form Explained The Motley Fool

Most people are in for a surprise when they receive a 1099C, never realizing that canceled debt is often treated just like any other dollar of ordinary income Creditors record canceled debts on a What to know about Form 1099C and cancellation of debt If you've received at least $600 in forgiveness for your student loans, you'll be sent a Form 1099C by your creditor The student loan forgiveness form will include the following information The lender The amount of the discharge (Box 2) 1099 C Tax Form Definition – A 1099 Form is basically a form that allows you to definitely monitor and report any income, expenses, or business transactions that are because of for reporting You'll need a tax form called a 1099 for a lot of factors

1099 C Cancellation Of Debt Will You Owe Taxes Credit Com

1099 C Discharge Without Debt Cancellation Not Consumer Protection Law Violation Mcglinchey Stafford Jdsupra

What is Form 1099C? Dear Dani, Though the name printed at the top of the 1099C form says "Cancellation of Debt," it is not always true to its name It may mean the bank has forgiven the debt Unfortunately, you can't count on it Banks are required to send you a 1099C when any "identifiable event" occurs A 1099C is a tax form that the IRS requires lenders use to report "cancellation of indebtedness income" This form must be filed in certain circumstances where more than $600 in debt is cancelled, or goes unpaid for a certain period of time The lender files this form with the IRS and a copy is supposed to be sent to the taxpayer as well

1

What Is Firpta And How Do I Avoid It Koontz Associates Pl Real Estate Business Tax Law

Not a good day Synchrony sent me a 1099 C from 06 Hi Today I got in the mail a 1099 C from Synchrony bank for $1700 for 19 Had to call the number on the the 1099 C for Synchrony bank to find out what account and what year it was for Thay told me was charge off 06, the form show transaction date of May of 19 Accountant 9,7 satisfied customers Hi, for a California nonrecourse foreclosure, a person should Hi, for a California nonrecourse foreclosure, a person should only receive a 1099A with box 5 checked as No (Not personally liable for the debt), and a 1099C should not be issued as there is no can read moreForm 1099C A form that a lender files with the IRS if it cancels a debt in excess of $600 Lenders are required to file 1099C whether the borrower is a natural person or legal person

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Sec Filing Xbiotech

What is a 1099C?The 1099 form is a series of documents the Internal Revenue Service (IRS) refers to as "information returns" There are a number of different 1099 forms that report the various types of income you may receive throughout the year other than the salary your employer pays you The person or entity that pays you is responsible for filling out theA Form 1099C is received when a debt (home, credit card, student loan, etc) you had is cancelled This happens when you receive money or goods but, due to circumstances, are not required to pay all or a portion of the amount back to the borrower (debt was cancelled) Because you are not paying the whole amount of the debt back, the IRS

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

Chase 1099 Reporting Thread Churning

Form 1099 is an informational form It is sent out routinely and without much thought on the creditor's part When real property changes hands or when a debt is forgiven, the creditor involved is required to report the transaction to the IRS You, the potentially affected taxpayer, get a

3

238 1099 Stock Photos Free Royalty Free 1099 Images Depositphotos

What Is A 1099 C Cancellation Of Debt Form Bankrate

Pdf An Initial Description Of The C Form

Debt Forgiveness The Pros And Cons Lexington Law

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Reporting Income For Grubhub Doordash Postmates Uber Eats Contractors

Www Calt Iastate Edu System Files Premium Video Files Form 1099 misc webinar 17 powerpoint Pdf

Form 1099 Nec For Nonemployee Compensation H R Block

1099 C What You Need To Know About This Irs Form The Motley Fool

Tax Forms Irs Tax Forms Bankrate Com

1099 C Surprise Canceled Debt Often Taxable As Income Creditcards Com

Taxes For Actors Deductions Deadlines More Backstage

Help I Just Got A 1099 C But I Filed My Taxes Already

1099 Form Irs Website

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

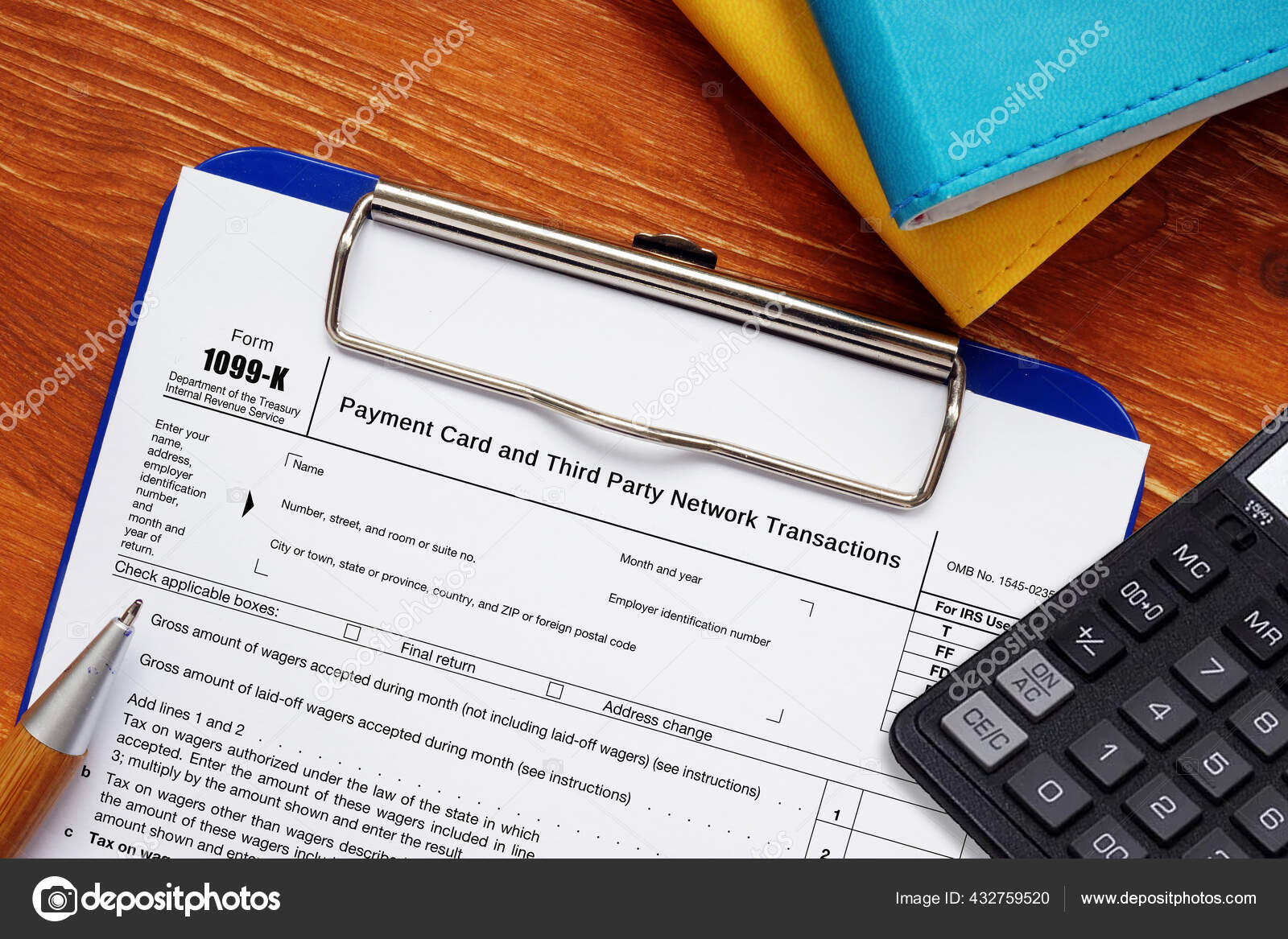

Form 1099 K Payment Card And Third Party Network Transactions Definition

What You Need To Know About 1099 C The Most Hated Tax Form

Understanding Your Form 1099 K Faqs For Merchants Clearent

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

1

What Happens With Canceled Debt Experian

Collectors Still Calling After A 1099 C Cancellation Of Debt Tax Form Creditcards Com

1099 Misc Box 7 Lacerte

How Canceled Student Loan And Mortgage Debts Could Affect Your Taxes Marketwatch

Understanding A 1099 C For Your Student Loan Debt

What Is Form 1099 Nec Who Uses It What To Include More

Www Reginfo Gov Public Do Downloaddocument Objectid

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

Www Irs Gov Pub Irs Pdf P12 Pdf

1

Buy Online Midi Dress Reserved 1099c 22x

/paying-medical-debt-with-credit-card-999e507c2a4f4580a71db69b6269377c.jpg)

What Is Irs Form 1099 C

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Irs Form 9 Is Your Friend If You Got A 1099 C

Tax Code Extensions Mean An Amended 17 Return Might Lessen Your Debt Press Enterprise

Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 18compositeform1099guide Pdf La En

Irs Tax Form 1099 Misc Instructions For Small Businesses Contractors

What Is A 1099 C Cancellation Of Debt Form Bankrate

What Is Insolvency Creditrepair Com

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Form 1099 R Wikipedia

How To Deal With A New 1099 C Issued On Old Debt Using Little Known Irs Form 4598

What To Do If You Get This Most Dreaded Tax Form Marketwatch

:max_bytes(150000):strip_icc()/Screenshot23-9b7ca8ec7adf4e11b37a6eb53f751745.png)

Irs Form 1040 X What Is It

238 1099 Stock Photos Free Royalty Free 1099 Images Depositphotos

Home Barclays Content Dam Home Barclays Documents Misc Fatca W9 Pdf

Form W 9 Wikipedia

:max_bytes(150000):strip_icc()/ScreenShot2021-06-03at10.46.06AM-94eb26d209884e0e9190a59995dbee63.png)

What Is Irs Form 1099 C

Best Tax Filing Software 21 Reviews By Wirecutter

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

What Is A 1099 Form Taxact Q A Series

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

Debt Forgiveness The Pros And Cons Lexington Law

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

What Is A C Corporation What You Need To Know About C Corps Gusto

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

1099 Cs Meeting Irs Requirements

Www Irs Gov Pub Irs Prior I1099 00 Pdf

Www Irs Gov Pub Irs Prior I1099 1999 Pdf

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

All About Tax Form Mailing 1099 And W2 Envelopes

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

About Form 1099 C Cancellation Of Debt Plianced Inc

How To Read Your 1099 Robinhood

What Are The Requirements To Not Report All Stock Transactions On The Tax Return 1099 B Personal Finance Money Stack Exchange

How To Download C Forms Issued Report In Commercial Tax Website Youtube

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

Irs Form 1099 C And Canceled Debt Credit Karma Tax

Irs Form 9 Is Your Friend If You Got A 1099 C

Www Ubs Com Content Dam Static Wmamericas Irsform1099 Reporting Pdf

0 件のコメント:

コメントを投稿